Property tax estimator

We Are The Leaders In Property Tax Challenges On Long Island. This Tax Estimator is based on the following assumptions.

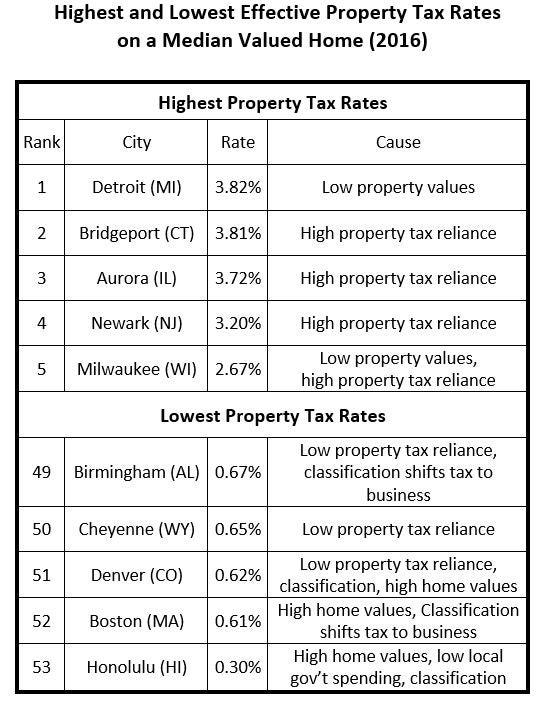

Property Taxes Property Tax Analysis Tax Foundation

For more information about exemption.

. Real Property Tax Estimator. This webpage has been moved here. What will the reassessment mean to your taxes in 2013.

Property Tax Estimator Property Tax Estimator You can now access estimates on property taxes by local unit and school district using 2020 millage rates. The estimator does not and will not provide actual taxes. Push button 1 to get started.

Please update your bookmarks accordingly. Valid for Real Property Only not Tangible Personal Property. Select your tax district from the drop-down menu.

Calculator is designed for simple accounts. Referring client will receive a 20 gift card for each valid new client referred limit two. All calculations on the web site now reflect over 115000 informal and formal appeals decisions.

Ad Our Mission Is To Ensure You Pay The Lowest Property Tax Required By Law. Type in your homes market value. Tom Durrant 87 North 200 East STE 201 St.

This will either be your city or unincorporated. Using the property tax estimator tool is easy as 1-2-3. This Supplemental Tax Estimator is.

Taxpayer Rights Remedies. This estimator is designed to help you estimate property taxes after purchasing your home. Gift card will be mailed approximately two weeks after referred client has had his or.

The Supplemental Tax Estimator provides an estimate of supplemental taxes along with an estimate of property tax liability for the following tax year. Ad 20Yrs Commercial Property Expert. When calculating your property tax liability you will take the tax-assessed value of your home and divide it by the millage rate mill 25 mills for each 1000 in property value.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. Vehicle Property Tax Estimator Please enter the following information to view an estimated property tax. We can only provide estimates for the counties listed in the drop-down menu.

Simply enter the SEV for. In order to benefit from a property tax exemption you must meet the eligibility criteria and apply at one of our office locations. If your county isnt among the.

Annexed The residential property assessment class includes single-family homes condominiums townhouses and other properties of three or fewer dwelling units. After a property transfers State law Proposition 13 passed in 1978 requires the Assessors Office. Tax Rate City ISD.

County and School Equalization 2023 Est. Get an estimate of your property taxes using the calculator below. Property Tax General Information PDF Resources Forms.

The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes. This calculator is designed to estimate the county vehicle property tax for your. Ad Find Out the Market Value of Any Property and Past Sale Prices.

Property Tax Calculator

Harris County Tx Property Tax Calculator Smartasset

Secured Property Taxes Treasurer Tax Collector

Real Property Tax Howard County

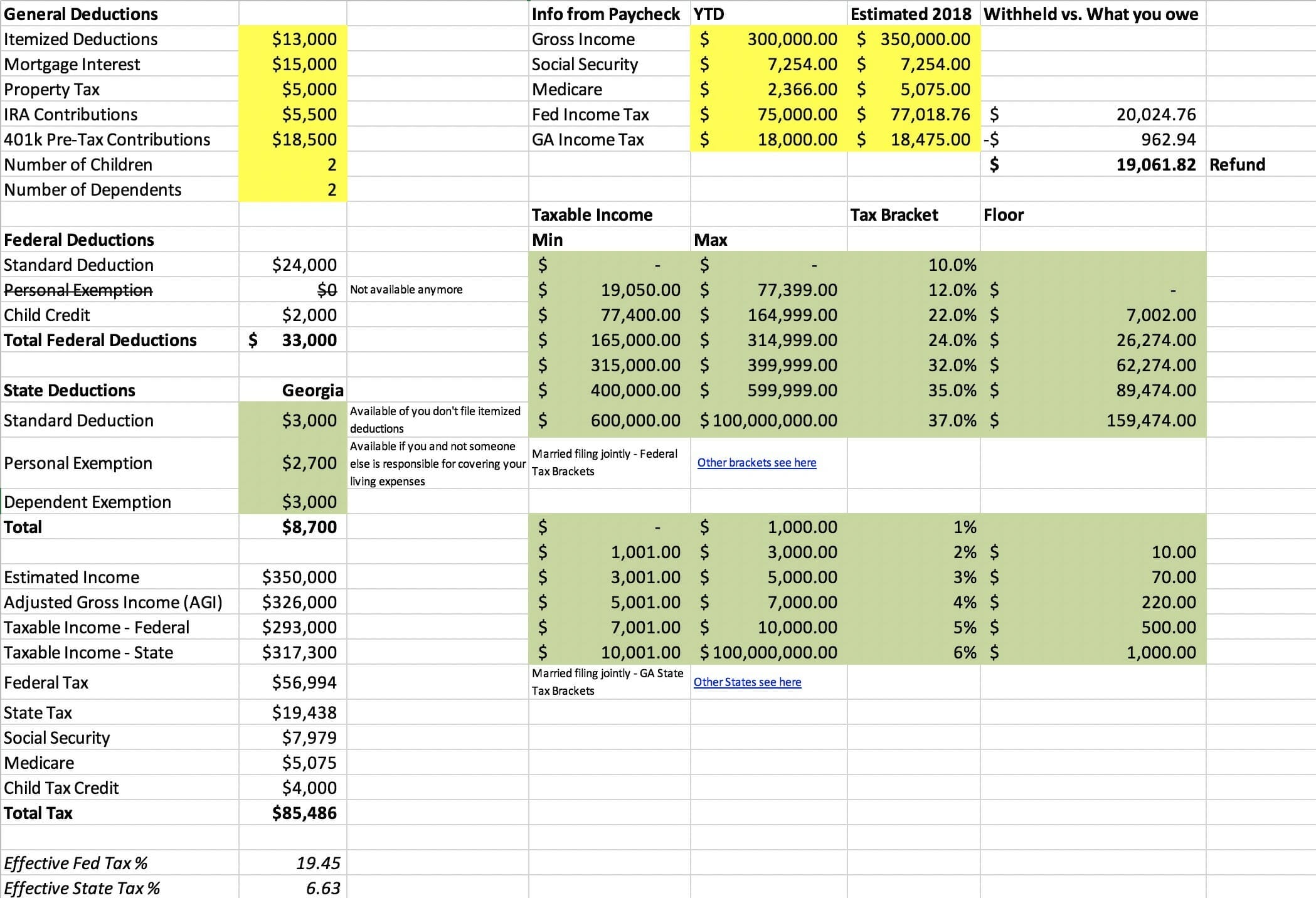

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

The Property Tax Equation

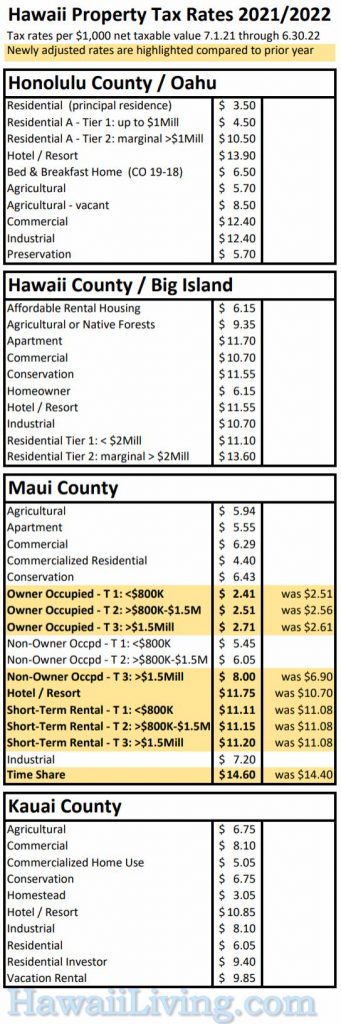

New Hawaii Property Tax Rates 2021 2022

Property Tax How To Calculate Local Considerations

Kansas Property Tax Calculator Smartasset

2022 Property Taxes By State Report Propertyshark

Property Taxes Property Tax Analysis Tax Foundation

Property Taxes Property Tax Analysis Tax Foundation

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

States With The Highest And Lowest Property Taxes Property Tax Tax States